Learn about the tax requirements when applying for a marriage green card

The U.S. government wants to see evidence that the spouse seeking a marriage-based green card will be financially secure once in the United States, and isn’t likely to rely on public benefits in the future.

It can be confusing trying to figure out what tax evidence you need to include with your marriage green card application, especially since there are additional requirements under the new public charge rule.

In this guide you will learn:

- Who needs to provide tax documents

- Which type of tax documents do you need to include?

- What a sample tax return transcript looks like

- How many years of tax returns are required

- What if you filed joint taxes?

- What if you or your spouse didn't file taxes?

Who Needs to Provide Tax Documents?

The sponsoring spouse needs to provide U.S. federal tax returns as part of Form I-864 (officially called the “Affidavit of Support”), a signed document to promise financial support of the spouse seeking a green card. If the sponsoring spouse and their household are unable to meet the minimum financial requirements of a family-based green card, then a joint sponsor will also need to include their tax returns. Learn more about the additional documents needed for joint filers here.

If the sponsoring spouse didn’t file taxes in the United States, they will need to provide an exemption letter. Learn more here.

For applicants filing from within the United States

A spouse seeking a green card from within the United States, as well as each household member, must include their most recent tax returns as part of Form I-944 (officially called the “Declaration of Self-Sufficiency”).

For applicants filing from outside the United States

As part of Form DS-5540 (officially called the “Public Charge Questionnaire”), the spouse seeking a green card from outside the United States must provide their most recent year’s tax return only if they have filed taxes in the United States.

Which Types of Tax Documents Do I Need to Include?

The types of tax documents needed depends on the form.

Financial Support Form (I-864)

The sponsoring spouse (and financial co-sponsor if any) will need to provide the following tax evidence as part of Form I-864:

| Document Type | Examples of Acceptable Documents | Who Needs It? |

| Proof of ability to financially support the spouse seeking a green card | Sponsoring spouse and financial co-sponsor (if any) |

Public Charge Test (I-944)

The spouse seeking a green card, and any other household member, will need to provide the following tax evidence as part of Form I-944:

| Document Type | Examples of Acceptable Documents | Who Needs It? |

| Proof of income |

|

Spouse seeking a green card from within the United States + any other household member |

Self-Sufficiency Form (DS-5540)

The spouse seeking a green card will need to provide the following tax evidence as part of Form DS-5540:

| Document Type | Examples of Acceptable Documents | Who Needs It? |

| Proof of income |

|

Spouse seeking a green card from outside the United States |

Note: Unlike Form I-864, the tax return transcript is the only acceptable form of tax evidence that the U.S. government will accept as part of forms I-944 and DS-5540.

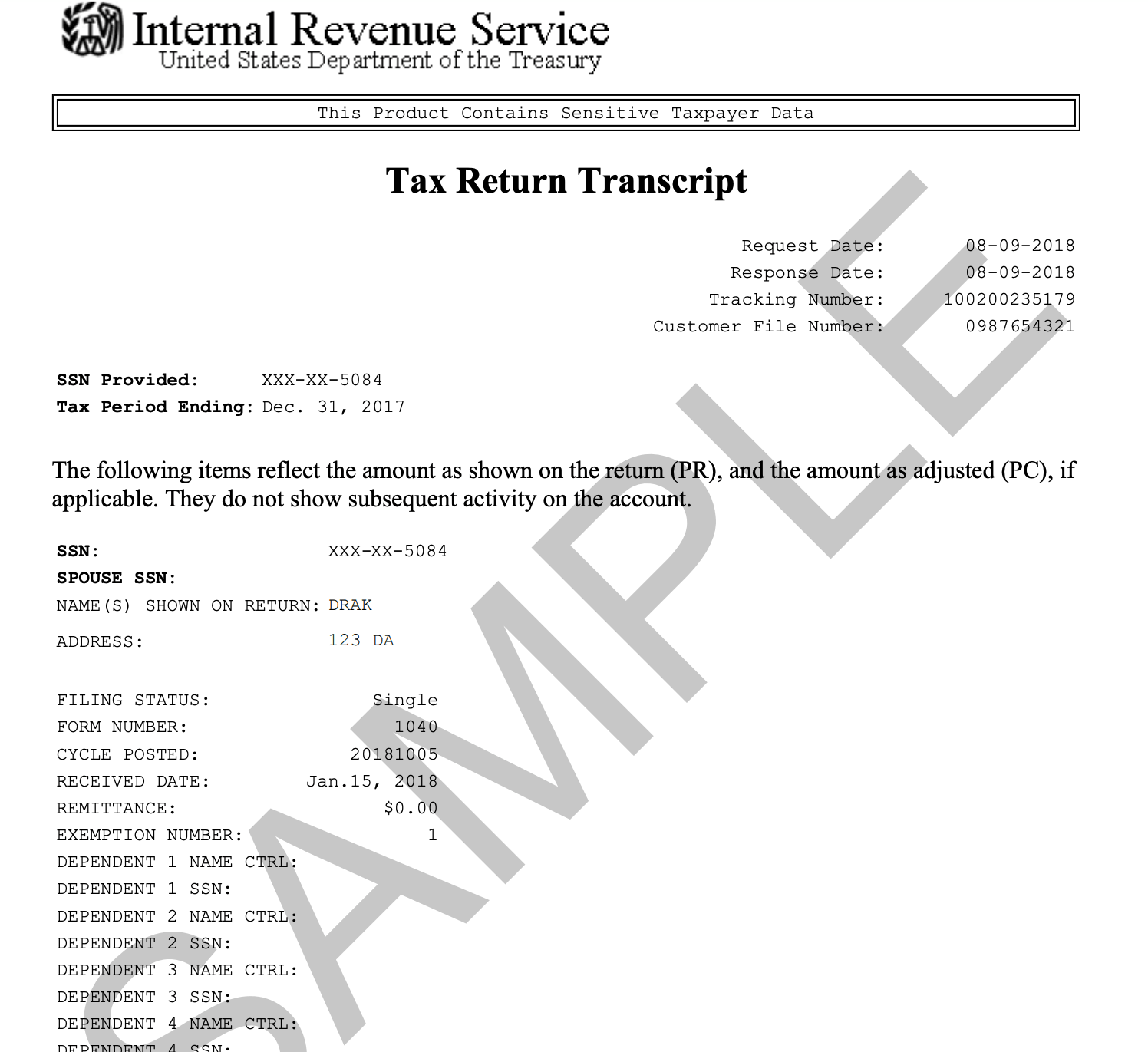

What Does a Tax Return Transcript Look Like?

A federal tax return transcript is a document that shows a summary of your tax return information. The sponsor can request their transcripts from the Internal Revenue Service (IRS) website for the most recent 3 years they filed taxes.

What should I do if I can't access my Tax Return Transcript from the IRS website?

If you can’t access your tax return transcript for a particular filing year, you instead need to provide a signed affidavit (written statement) explaining why you’re unable to obtain the transcript and that you will continue to try to obtain it to bring to your green card interview. You’ll also need to provide a screenshot of the IRS website showing that your transcript is inaccessible through the IRS "Get Transcript" tool.

The best way to ensure your green card application doesn’t get delayed is to file all your paperwork correctly the first time around.

How Many Years of Tax Returns Are Required?

For forms I-864, I-944, and DS-5540, the U.S government requires proof of tax filing for the most recent filing year (typically the previous calendar year). Note that for the I-864, the sponsor (and co-sponsor if any) has the option to provide tax filings from the past 3 years.

What If You Filed Joint Taxes?

If the couple filed joint taxes, they will need to provide their federal tax return transcript and all supporting documents (including the W-2, 1099, or foreign income statements and schedules). This requirement applies to forms I-864, I-944, and DS-5540.

What If You or Your Spouse Didn’t File Taxes?

If the sponsoring spouse (or joint sponsor if applicable) didn’t file any taxes in the previous year, they will need to provide an exemption letter as part of Form I-864 explaining why they didn’t file taxes. The letter should explain that the sponsor’s income was below the minimum income required to file in the previous years or years, and therefore they did not file a federal tax return for those years.

The spouse seeking a green card, either from within or outside the United States, will not need to include an exemption letter if they did not file any U.S. taxes in the previous year. They also do not need to include any foreign tax returns.